To help you get a sense of what others are paying, we analyzed the most recent quote data from real renters in the area. It’s a quick way to understand the local market before comparing your own options.

How much are people paying for Renters Insurance in Audubon?

Based on data submitted over the past 12 months, the average renters insurance premium in Audubon is $102 per year, or around $8 per month. To give you a better idea, here are a few recent quotes from renters in Audubon and nearby areas:

| Quote Date | City | Monthly Premium | Property Type | Age Group |

|---|---|---|---|---|

| Feb. 26, 2026 | Philadelphia, PA | $12 | Apartment | 18–24 |

| Feb. 26, 2026 | Philadelphia, PA | $15 | Apartment | 18–24 |

| Feb. 26, 2026 | Erie, PA | $31 | Apartment | 25–34 |

| Feb. 26, 2026 | York, PA | $7 | Apartment | 55+ |

| Sept. 25, 2024 | Audubon, PA | $9 | Apartment | 25–34 |

* Selected, anonymized quotes from past submissions. Last updated: Feb. 26, 2026.

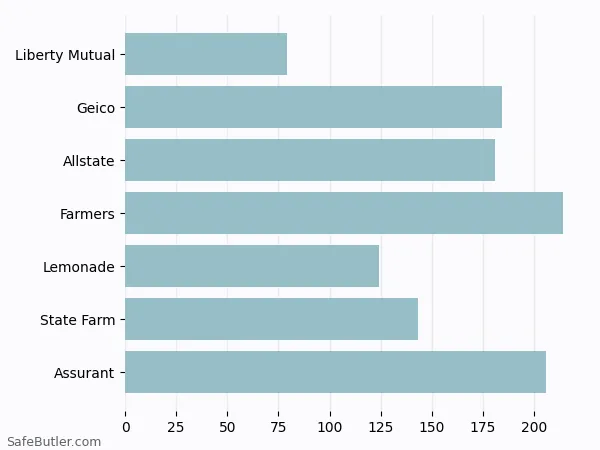

While the quotes above reflect what real renters have recently seen, here’s another way to look at it: If you’re a 20-year-old student with no recent claims and basic coverage, some brands offer renters insurance in Audubon starting around $79/year, with others going up to about $214/year depending on the provider and options.

As you can see, the prices vary quite a lot in Audubon. So, what policy is the best option for you? Hit the big button below to get your free quotes.

Compare your options now — it’s free.

What factors determine renters insurance premium?

The department of insurance has regulations in place regarding what factors can be used to determine your insurance premiums. In most cases, your location, age, and the coverage you seek are the most significant factors for your renter's insurance premium. In some states, your credit score is also taken into account and is an essential factor.

- The amount of coverage you chose

- The value of your personal property and whether your policy covers ACV or replacement costs

- The amount of your deductible

- The amount of liability coverage you choose

- The location of your rental home

Are the crime rates exceptionally high in your neighborhood? Rates may be higher as a result. Is the area prone to higher risks for wind or hurricane damage? These factors matter as well. - Discounts

You may be eligible for discounts if you have purchased other insurance policies with the provider or bundled your insurance. There are also discounts available for renters with added security features- such as deadbolt locks, security systems, smoke detectors, etc.

Common renters insurance discounts

Most carriers provide various discounts for renters insurance, much like auto insurance. Below, you’ll find the most common discounts. Click here to start a free and personalized insurance quote to compare all the discounts.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify for a discount for the auto insurance. |

| Secure Home | If you have extinguishers and burglar alarm devices or are in a gated community, you may qualify for the secured home discount, which averages about 5% for most carriers. |

| Claim-free | Like auto insurance is lower for accident-free drivers, renter's insurance is cheaper for claim-free tenants. If you have never reported any claims, you will qualify for claim-free discounts from several carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. So, if you’re a college student and trying to find a renter’s policy for your apartment near school, you are likely to pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those with lower credit scores. |

| Pay-in-full | If the carrier supports monthly and yearly payments, paying in full each year will likely give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee your carrier charges. |

| Paperless | A few carriers still provide paper statements; therefore, they will offer paperless discounts if you opt-in. But you will find competitive premiums from more modern companies whose operation is digitized even without paperless discounts. |

What are other risks to consider in Audubon?

Unfortunately, most renter’s insurance policies do not cover damages to your personal property caused by a flood or an earthquake. Audubon tenants do face the risks of natural hazards such as hurricane, floods, and storms . Therefore, it is also a good idea to check with your insurance agent and learn more about what policies cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in today’s digital world, it is also essential to check if your renter’s insurance provides identity theft protection.

Does renters insurance cover roof leaking in Audubon?

Renters insurance focuses on providing coverage for the renter, which does not cover any property damage, including roof leaks. Instead, the owner/landlord is responsible for their insurance (Landlord insurance) to cover those costs. However, renters insurance policies can give you protection for the following things: medical expenses for any injuries sustained in the emergency, personal property damage by the roof leaking, living expenses such as finding a new place to live after the current residence is damaged, personal liability, etc.

Learn more about Pennsylvania renters insurance

If you are wondering how much the premium costs and what discounts are available in Pennsylvania, click here to learn more about Pennsylvania renters insurance.

References

Ready to see your personalized price?

It only takes a few seconds — and could save you a lot over time.

Disclaimer

Our articles are intended for informational purposes and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.