Homeowner insurance is essential for many people. It is one of the types of insurance to protect your home, your property, and your liability for injuries on your property. Massachusetts has natural hazards such as snowing, hurricane, and coastal storms. It's a good idea to understand what homeowner insurance covers, what other insurance are great supplements, and how much coverage you should buy.

How much is homeowner's insurance in Massachusetts?

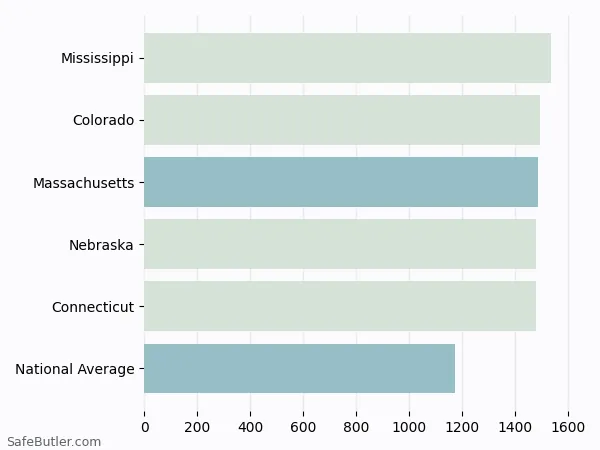

In Massachusetts, the homeowner's insurance premium is $1,488 a year or $124 per month on average, which is much higher than the national average. The below chart compares Massachusetts with four other states with similar premiums, as well as the national average.

If you are wondering how much it costs for you, hit the big button below to get your free quotes.

What factors impact the Homeowner Insurance premium?

- Your Coverage Amount

- Location

- Neighborhood Crimes

- Age of the Home

- Conditions and Materials of Your Home

- Number of Primary Inhabitants

- Area and Personal Claim Histories

What discounts are available for Homeowner Insurance?

Most carriers provide various discounts for homeowner insurance such as multiple-policy discounts or clean claim history discounts.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both home and auto insurance from the same company, you may qualify a discount for both auto and homeowner insurance. |

| Secure Home | If you have extinguishers, burglar alarms devices or you are in a gated community, you may qualify for the secured home discount. This averages about 5% from quite a few carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, homeowner insurance is also cheaper for claim free residents. If you have never reported any claims before, you will qualify for the claim-free discounts from quite a few carriers. |

| Loyalty | Some carriers, especially those largest ones, offer loyalty discount if you have been with them for a few years. If you do have, you can see this discount from your declaration page or talk to your insurance agent. |

| Home Improvements | This often is the most critical discounts that highly impact your premium. If you have recent home improvements such as replacing your roof, your electricity or any other building materials, you definitely need to include that in your quotes. This usually could contribute most in your saving. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those who don’t. |

| Pay-in-full | If the carrier supports both monthly and yearly payment, usually paying-in-full will give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee charged by your carrier. |

| Paperless | A few carriers even provide paperless discounts. But more and more new insurance carriers do not offer it probably because the overall cost has already been saved. |

Looking for the best Homeowner insurance in Massachusetts?

Click here to get started. You can compare hundreds of Homeowner insurance companies at once to get free, no-obligation quotes in just 60 seconds.

Homeowner Insurance Rates for Cities in Massachusetts

We compiled data about Homeowner Insurance rates for every city in California. This list is updated on Jan 06, 2020. A word of caution, as you explore the list below, there is no doubt you will find a wide price range.

- Abington

- Acton

- Acushnet

- Adams

- Agawam

- Amesbury

- Amherst

- Amherst Center

- Andover

- Arlington

- Ashland

- Athol

- Attleboro

- Auburn

- Ayer

- Barnstable Town

- Bedford

- Belchertown

- Bellingham

- Belmont

- Beverly

- Billerica

- Blackstone

- Boston

- Bourne

- Boxford

- Braintree

- Brewster

- Bridgewater

- Brockton

- Brookline

- Burlington

- Cambridge

- Canton

- Carver

- Charlton

- Chatham

- Chelmsford

- Chelsea

- Chicopee

- Clinton

- Cochituate

- Cohasset

- Concord

- Dalton

- Danvers

- Dartmouth

- Dedham

- Dennis

- Dighton

- Douglas

- Dracut

- Dudley

- Duxbury

- East Bridgewater

- East Falmouth

- East Longmeadow

- Easthampton

- Easton

- Everett

- Fairhaven

- Fall River

- Falmouth

- Fitchburg

- Foxborough

- Framingham

- Franklin

- Freetown

- Gardner

- Georgetown

- Gloucester

- Grafton

- Granby

- Great Barrington

- Greenfield

- Groton

- Groveland

- Halifax

- Hamilton

- Hanover

- Hanson

- Harwich

- Haverhill

- Hingham

- Holbrook

- Holden

- Holliston

- Holyoke

- Hopkinton

- Hudson

- Hull

- Ipswich

- Kingston

- Lakeville

- Lancaster

- Lawrence

- Leicester

- Leominster

- Lexington

- Lincoln

- Littleton

- Longmeadow

- Lowell

- Ludlow

- Lunenburg

- Lynn

- Lynnfield

- Malden

- Mansfield

- Mansfield Center

- Marblehead

- Marlborough

- Marshfield

- Mashpee

- Mattapoisett

- Maynard

- Medfield

- Medford

- Medway

- Melrose

- Merrimac

- Methuen

- Middleborough

- Middleborough Center

- Middleton

- Milford

- Millbury

- Millis

- Milton

- Monson

- Montague

- Nantucket

- Natick

- Needham

- New Bedford

- Newbury

- Newburyport

- Newton

- Norfolk

- North Adams

- North Amherst

- North Andover

- North Attleborough

- North Attleborough Center

- North Reading

- Northampton

- Northborough

- Northbridge

- Norton

- Norwell

- Norwood

- Orange

- Orleans

- Oxford

- Palmer

- Peabody

- Pembroke

- Pepperell

- Pinehurst

- Pittsfield

- Plainville

- Plymouth

- Quincy

- Randolph

- Raynham

- Reading

- Rehoboth

- Revere

- Rockland

- Rockport

- Rutland

- Salem

- Salisbury

- Sandwich

- Saugus

- Scituate

- Seekonk

- Sharon

- Shirley

- Shrewsbury

- Somerset

- Somerville

- South Hadley

- South Yarmouth

- Southborough

- Southbridge

- Southwick

- Spencer

- Springfield

- Sterling

- Stoneham

- Stoughton

- Sturbridge

- Sudbury

- Sutton

- Swampscott

- Swansea

- Taunton

- Templeton

- Tewksbury

- Topsfield

- Townsend

- Tyngsborough

- Uxbridge

- Wakefield

- Walpole

- Waltham

- Ware

- Wareham

- Watertown

- Wayland

- Webster

- Wellesley

- West Boylston

- West Bridgewater

- West Springfield

- West Yarmouth

- Westborough

- Westfield

- Westford

- Westminster

- Weston

- Westport

- Westwood

- Weymouth

- Whitinsville

- Whitman

- Wilbraham

- Williamstown

- Wilmington

- Winchendon

- Winchester

- Winthrop

- Woburn

- Worcester

- Wrentham

- Yarmouth

References

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are intended for informational purposes and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.