Wondering whether YOU need life insurance? What IS life insurance, exactly? We’ll answer those questions and more- consider this your life insurance primer! Life insurance is a contract between you and your insurer that provides a tax-free lump sum of money to replace lost income after your death. If you have debts, dependents, or just want assurance that your loved ones will have access to means to settle your accounts when you’re gone, you’ll need life insurance.

Life insurance premiums vary according to the amount of coverage, age, health, and lifestyle of the insured, as well as other variables. The money from a life insurance policy can be used to pay expenses like a mortgage, utility and grocery bills, children's college costs, final funeral arrangements, and more. Let’s get into the details.

💡Takeaway: Life insurance premiums are generally affordable, and offer financial protection to those whose friends, family, or business rely on them.

How much does life insurance cost in South Carolina?

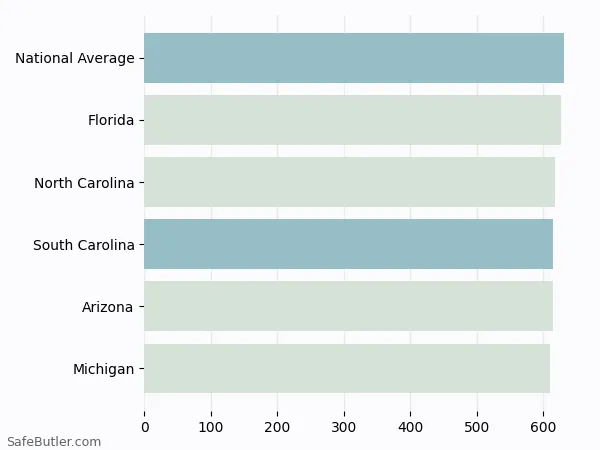

As mentioned above, there is a range of pricing when it comes to life insurance premiums that varies across states. According to data from S&P Global Market Intelligence1, the average life insurance premium in South Carolina is $615, or $51 a month. Standards of living, risk factors, and more are taken into account in order to arrive at these rates. In addition, there are additional factors to consider, such as gender and age.

To see how the rates in South Carolina stack up against the national average, and four other states with close premium, take a look at the chart below.

If you are wondering how much it costs for you, hit the big button below to get your free quotes.

What factors will impact the cost of Life Insurance?

- Age

Your age is the biggest factor impacting the cost of your life insurance policy premiums. Younger policyholders pay lower premiums, and as you age, the likelihood an insurer will have to pay out on your policy increases, making you a higher risk. This is the primary reason older policyholders pay higher premiums. - Gender

Women, on average, have a longer life expectancy than men. In the United States women live an average 81.1 years, while men live an average 76.1. Thanks to this difference, women tend to pay less for life insurance than men do. - Smoking

Whether you are a smoker or not will also have an impact on your life insurance premiums. Smoking is linked to potentially fatal diseases like cancer, which make smokers higher risk clients for insurers, and cause higher premiums. If you quit smoking after purchasing life insurance, you can call your provider and see if your new nonsmoking status will lower your costs. - Health

Many insurers require a medical exam and health records prior to issuing a policy. This is normal, and allows them to calculate certain risk factors, like a history of serious medical conditions like heart disease and cancer. It also allows the insurers to look at medical indicators of higher risk categories for future medical conditions, such as weight, cholesterol levels, and blood pressure. - Lifestyle

Whether it’s your great passion for high-risk hobbies, like hang-gliding and free-climbing, or an occupation that exposes you to higher risks, like stunt pilots, roofers, and asbestos removal- your insurer may consider your lifestyle to be a factor that places you into a higher category of risk, which translates to higher premiums. - Family Medical History

If your family history includes serious medical conditions-especially hereditary diseases- it could factor into your coverage, even if you yourself have no current medical conditions. - Driving History

While your driving record doesn’t typically have a drastic impact on your life insurance premiums, especially risky behaviors, such as getting multiple speeding tickets over the course of a six month period, can certainly drive costs up. -

Bundling of Auto and Home Policies

Many insurance companies will offer special discounts to policy-holders who have multiple policies with the same company. It’s always smart to see if you can save additional costs by bundling your policies with a single insurer. - Term Length

Policies that are issued for larger benefit amounts over longer terms generally are more expensive than policies with smaller benefit amounts over shorter periods. There are also differences between whole and term life insurance policies. Whole, also known as permanent, life insurance policies run more expensive than term life insurance policies.

💡Wondering how much life insurance costs for you?

Life insurance price jumps after age 35, or you underlie medical conditions. Click here to start a free quote now.

What are the differences between whole and term life insurance policies?

Essentially, the two primary forms of life insurance are whole, or permanent life insurance policies, and term life insurance policies. Term life insurance covers you for a specific time period, generally 10-30 years, while whole life insurance covers you for the duration of your life.

- Term Life Insurance

Term life insurance policies are generally less complex than whole life insurance policies. Term policies cover you for a predetermined number of years (between 1-30), after which you stop paying premiums and the coverage expires. This type of coverage is more affordable, because it has fewer bells and whistles. If you die during the term, your beneficiaries will receive a death benefit. If however, you outlive the term, you get nothing from the insurance company. Term is the most affordable type of life insurance. Term life insurance can be canceled before it expires without losing any value, but when it expires, so will your coverage. If you still want a life insurance coverage, you’ll need to either shop for a new policy or convert your policy into a form of permanent life insurance. - Whole Life Insurance

Also known as permanent life insurance, whole life insurance premiums are paid for your whole life. When you die, your beneficiaries will receive a death benefit. As there is no specified term, your beneficiaries will receive the death benefit whenever you expire. There are various types of whole life insurance, and many have a cash value component that increases as you pay your premiums.

Eventually, the cash value may increase the death benefit as well. Some allow for dividends on the accumulated cash, and some allow for cash withdrawals or to be used as loan collateral. However, drawing against your life insurance policy can lead to a reduction in death benefits that could impact your beneficiaries negatively. Among the other forms of permanent life insurance are universal life insurance, and variable life insurance. These use a specific stock index and asset investment selection as forms of accruing death benefits, respectively. Finally, there is also the option of paid-up whole life insurance, which lets you pay increased premiums for a set number of years, after which you’re covered until your death.

What steps do I take to purchase a life insurance policy?

The good news? You’re already here, and learning more about life insurance policies is the first step. Do your research, and decide how much coverage you’ll need.

- Budget

Take a good look at your finances and financial obligations, and decide how much coverage you can afford. - Consult a professional

Compare quotes and speak with a professional to help you determine which policy, and what type of policy, is the best fit for your needs and budget. - Purchase your policy

Depending on the policy you choose, you may need to get a physical exam, fill out forms about your lifestyle, and other prequalifying steps.

How does COVID-19 Impact Life Insurance Coverage?

Can I get life insurance if I recently traveled or plan to travel internationally?

If, in the past 30 days, you traveled to a foreign country or any area that has a U.S. state department level 3

or 4 travel advisory, your life insurance policy application will need to be delayed due to potential exposure

to COVID-19. However, 30 days after the date you return to the U.S. you will be able to submit your life

insurance application.

Does life insurance cover COVID-19 deaths?

There has been some agitation on social media suggesting that some death benefits were denied to beneficiaries

of policies that were covering patients that died as a result of the COVID-19 pandemic. The agitation, however,

is simply speculation. There are no known policies that specifically exclude death from infectious disease.

There are some very specific exceptions, for example, a policy specifically written for a “dread disease” or

specific condition, such as cancer, may not be paid if the insured instead dies from COVID-19.

This sort of case would be incredibly rare. Other than a specific mitigating factor, like failure to pay premiums, or dishonesty on the application for the policy, there would be no reason that dying from COVID-19 would cause an insurer to fail to pay the benefit.

Looking for the best Life insurance in South Carolina?

Click here to get started. You can compare hundreds of Life insurance companies at once to get free, no-obligation quotes in just 60 seconds.

Find the best life insurance in South Carolina

Compare the top insurance brands at once for free

Life Insurance Rates for Cities in South Carolina

We compiled data about Life Insurance rates for every city in South Carolina. Depending on where you live within the state, you may notice variation in pricing.

- Aiken

- Anderson

- Beaufort

- Bennettsville

- Berea

- Burton

- Camden

- Cayce

- Charleston

- Chester

- Clemson

- Clinton

- Columbia

- Conway

- Darlington

- Dentsville

- Dillon

- Easley

- Five Forks

- Florence

- Forest Acres

- Fort Mill

- Fountain Inn

- Gaffney

- Gantt

- Garden City

- Georgetown

- Georgetown County

- Goose Creek

- Greenville

- Greenwood

- Greer

- Hanahan

- Hartsville

- Hilton Head Island

- Homeland Park

- Irmo

- Ladson

- Lake City

- Lancaster

- Laurel Bay

- Laurens

- Lexington

- Little River

- Lugoff

- Marion

- Mauldin

- Mount Pleasant

- Myrtle Beach

- Newberry

- North Augusta

- North Charleston

- North Myrtle Beach

- Oak Grove

- Orangeburg

- Parker

- Red Bank

- Red Hill

- Rock Hill

- Sans Souci

- Seneca

- Seven Oaks

- Simpsonville

- Socastee

- Spartanburg

- St. Andrews

- Summerville

- Sumter

- Taylors

- Union

- Wade Hampton

- Welcome

- West Columbia

- Woodfield

- York

References

- Market insider & S&P Global Market Intelligence

- NAIC

- U.S. Census Bureau

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are intended for informational purposes and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.