With rising awareness of flood zones and disaster prep, many Florida renters are treating insurance as an essential cost of living, not just a nice-to-have.

How much are people paying for Renters Insurance in Florida?

Here's what renters across Florida — including Port Richey, Merritt Island, Winter Springs, Fort Pierce, and Pembroke Pines — are actually paying today, based on real policy quotes from SafeButler.

| Quote Date | City | Monthly Premium | Property Type | Age Group |

|---|---|---|---|---|

| Feb. 17, 2026 | Port Richey, Florida | $21 | Apartment | 55+ |

| Feb. 17, 2026 | Merritt Island, Florida | $19 | Apartment | 45–54 |

| Feb. 17, 2026 | Winter Springs, Florida | $14 | Apartment | 45–54 |

| Feb. 17, 2026 | Fort Pierce, Florida | $25 | Apartment | 55+ |

| Feb. 17, 2026 | Pembroke Pines, Florida | $26 | Apartment | 55+ |

* Selected, anonymized quotes from past submissions. Last updated: Feb. 17, 2026.

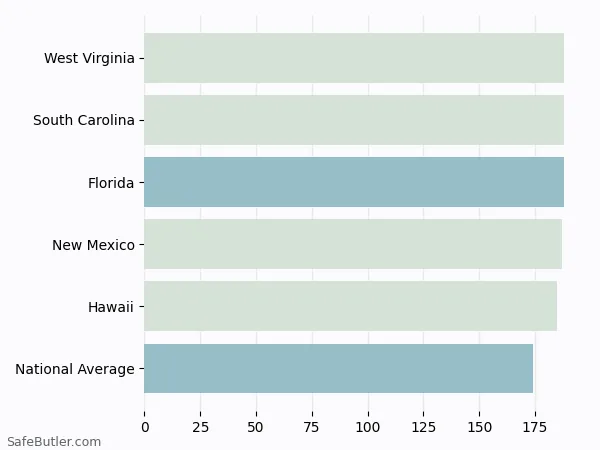

Renters insurance is one of the most affordable insurance in your daily life but can protect you financially from many risks. Florida tenants pay higher than the national average. The chart below compares four states with close premiums and the national average.

If you want to know how much it costs for your rental home, hit the big button below to get free quotes.

Compare your options now — it’s free

Why do YOU need Renters Insurance?

Although renters insurance is not required by law in Florida, apartment complexes and landlords often need tenants to purchase Renters Insurance before signing the lease agreement. Because the landlord's insurance only covers the damage to the actual dwelling, your renters insurance will protect your belongings inside the apartment in case of fire, theft, or injury.

What factors impact the Renters Insurance premium?

- The amount of coverage you chose

- The value of your personal property and whether your policy covers ACV or replacement costs

- The amount of your deductible

- The amount of liability coverage you choose

- The location of your rental home

Are the crime rates exceptionally high in your neighborhood? Rates may be higher as a result. Is the area prone to higher risks for wind or hurricane damage? These factors matter as well. - Discounts

You may be eligible for discounts if you have purchased other insurance policies with the provider or bundled your insurance. There are also discounts available for renters with added security features- such as deadbolt locks, security systems, smoke detectors, etc.

What are the Florida renters insurance discounts?

Most carriers provide various discounts for renters insurance, just like auto insurance. Here are some most common deals.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify for a discount for the auto insurance. |

| Secure Home | Secure home If you have extinguishers or burglar alarm devices or are in a gated community, you may qualify for the secured home discount. It averages about 5% from quite a few carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, renters insurance is also cheaper for claim-free tenants. If you have never reported any claims, you will qualify for claim-free discounts from several carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. If you're a college student trying to find a renters policy for your apartment near school, you will pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those who don’t. |

| Pay-in-full | If the carrier supports monthly and yearly payments, paying in full will usually give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee your carrier charges. |

| Paperless | A few providers have paperless discounts if you opt-in. But more modern insurance companies will give you a competitive offer directly with more digitalized systems. |

What are the risks to consider in Florida?

Florida tenants face the risks of natural hazards such as fire, hurricane, and freezing. However, most renters insurance policies do not cover damages to your personal property caused by a flood or an earthquake. Therefore, it is also a good idea to check with your insurance agent and learn more about what policies cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in today's digital world, it is also essential to check if your renter's insurance provides identity theft protection.

Looking for the best renters insurance in Florida?

Click here to get started. You can compare hundreds of Renters insurance companies at once to get free, no-obligation quotes in just 60 seconds.

Find the best renters insurance in Florida

Compare the top insurance brands at once for free

Renters Insurance Rates for Cities in Florida

We compiled data about Renters Insurance rates for every city in Florida. A word of caution, as you explore the list below, there is no doubt you will find a wide price range.

- Alachua

- Altamonte Springs

- Andover

- Apollo Beach

- Apopka

- Arcadia

- Atlantic Beach

- Auburndale

- Aventura

- Avon Park

- Azalea Park

- Bartow

- Bayonet Point

- Bayshore Gardens

- Beacon Square

- Bee Ridge

- Bellair-Meadowbrook Terrace

- Belle Glade

- Bellview

- Beverly Hills

- Bloomingdale

- Boca Del Mar

- Boca Raton

- Bonita Springs

- Boynton Beach

- Bradenton

- Brandon

- Brent

- Broadview Park

- Brooksville

- Brownsville

- Callaway

- Cape Canaveral

- Cape Coral

- Carol City

- Casselberry

- Century Village

- Cheval

- Citrus Park

- Citrus Ridge

- Clearwater

- Clermont

- Clewiston

- Cocoa

- Cocoa Beach

- Coconut Creek

- Collier Manor-Cresthaven

- Conway

- Cooper City

- Coral Gables

- Coral Springs

- Coral Terrace

- Country Club

- Country Walk

- Crestview

- Cutler

- Cutler Ridge

- Cypress Gardens

- Cypress Lake

- Dade City

- Dania Beach

- Davie

- Daytona Beach

- De Bary

- De Land

- Deerfield Beach

- Delray Beach

- Deltona

- Destin

- Doctor Phillips

- Doral

- Dunedin

- East Lake

- East Perrine

- Edgewater

- Eglin AFB

- Egypt Lake-Leto

- Elfers

- Englewood

- Ensley

- Estero

- Eustis

- Fairview Shores

- Fern Park

- Fernandina Beach

- Ferry Pass

- Florida City

- Florida Ridge

- Forest City

- Fort Lauderdale

- Fort Myers

- Fort Myers Beach

- Fort Pierce

- Fort Pierce North

- Fort Walton Beach

- Fountainbleau

- Fruit Cove

- Fruitville

- Gainesville

- Gibsonton

- Gifford

- Gladeview

- Glenvar Heights

- Golden Gate

- Golden Glades

- Golden Lakes

- Goldenrod

- Gonzalez

- Goulds

- Greater Carrollwood

- Greater Northdale

- Greater Sun Center

- Greenacres

- Gulf Gate Estates

- Gulfport

- Haines City

- Hallandale

- Hamptons at Boca Raton

- Hernando

- Hialeah

- Hialeah Gardens

- Hobe Sound

- Holiday

- Holly Hill

- Hollywood

- Homestead

- Homosassa Springs

- Hudson

- Hunters Creek

- Immokalee

- Indian Harbour Beach

- Inverness

- Inwood

- Iona

- Islamorada

- Ives Estates

- Jacksonville

- Jacksonville Beach

- Jasmine Estates

- Jensen Beach

- Jupiter

- Kendale Lakes

- Kendall

- Kendall West

- Key Biscayne

- Key Largo

- Key West

- Keystone

- Kings Point

- Kissimmee

- Lady Lake

- Lake Butter

- Lake City

- Lake Lorraine

- Lake Lucerne

- Lake Magdalene

- Lake Mary

- Lake Park

- Lake Wales

- Lake Worth

- Lake Worth Corridor

- Lakeland

- Lakeland Highlands

- Lakes by the Bay

- Lakeside

- Lakewood Park

- Land O’ Lakes

- Lantana

- Largo

- Lauderdale Lakes

- Lauderhill

- Laurel

- Leesburg

- Lehigh Acres

- Leisure City

- Lighthouse Point

- Live Oak

- Lockhart

- Longboat Key

- Longwood

- Lutz

- Lynn Haven

- Maitland

- Mango

- Marathon

- Marco Island

- Margate

- Marianna

- McGregor

- Meadow Woods

- Medulla

- Melbourne

- Melrose Park

- Memphis

- Merritt Island

- Miami

- Miami Beach

- Miami Lakes

- Miami Shores

- Miami Springs

- Micco

- Middleburg

- Milton

- Mims

- Miramar

- Mount Dora

- Myrtle Grove

- Naples

- Naples Park

- Neptune Beach

- New Port Richey

- New Port Richey East

- New Smyrna Beach

- Niceville

- Norland

- North Andrews Gardens

- North Bay Village

- North Fort Myers

- North Lauderdale

- North Miami

- North Miami Beach

- North Palm Beach

- North Port

- North Sarasota

- Oak Ridge

- Oakland Park

- Ocala

- Ocoee

- Ojus

- Oldsmar

- Olympia Heights

- Opa-locka

- Opa-locka North

- Orange City

- Orange Park

- Orlando

- Orlovista

- Ormond Beach

- Ormond-By-The-Sea

- Oviedo

- Pace

- Palatka

- Palm Bay

- Palm Beach

- Palm Beach Gardens

- Palm City

- Palm Coast

- Palm Harbor

- Palm River-Clair Mel

- Palm Springs

- Palm Valley

- Palmetto

- Palmetto Estates

- Panama City

- Panama City Beach

- Parkland

- Pembroke Park

- Pembroke Pines

- Pensacola

- Perry

- Pine Castle

- Pine Hills

- Pinecrest

- Pinellas Park

- Pinewood

- Plant City

- Plantation

- Poinciana

- Pompano Beach

- Pompano Beach Highlands

- Port Charlotte

- Port Orange

- Port Salerno

- Port St. John

- Port St. Lucie

- Princeton

- Punta Gorda

- Quincy

- Richmond Heights

- Richmond West

- Riverview

- Riviera Beach

- Rockledge

- Rotonda

- Royal Palm Beach

- Ruskin

- Safety Harbor

- San Carlos Park

- Sandalfoot Cove

- Sanford

- Sanibel

- Sarasota

- Sarasota Springs

- Satellite Beach

- Scott Lake

- Sebastian

- Sebring

- Seminole

- Shady Hills

- Siesta Key

- Silver Springs Shores

- South Bradenton

- South Daytona

- South Highpoint

- South Miami

- South Miami Heights

- South Patrick Shores

- South Venice

- Southeast Arcadia

- Southgate

- Spring Hill

- Springfield

- St. Augustine

- St. Cloud

- St. Pete Beach

- St. Petersburg

- Stuart

- Sugarmill Woods

- Sunny Isles Beach

- Sunrise

- Sunset

- Sweetwater

- Tallahassee

- Tamarac

- Tamiami

- Tampa

- Tarpon Springs

- Tavares

- Temple Terrace

- The Crossings

- The Hammocks

- The Villages

- Thonotosassa

- Three Lakes

- Titusville

- Town 'n' Country

- Treasure Island

- Union Park

- University

- University Park

- Upper Grand Lagoon

- Valparaiso

- Valrico

- Venice

- Venice Gardens

- Vero Beach

- Vero Beach South

- Villas

- Warrington

- Wekiwa Springs

- Wellington

- West Little River

- West Melbourne

- West Palm Beach

- West Pensacola

- West Perrine

- West Vero Corridor

- West and East Lealman

- Westchase

- Westchester

- Westgate-Belvedere Homes

- Weston

- Westview

- Westwood Lakes

- Williamsburg

- Wilton Manors

- Winston

- Winter Garden

- Winter Haven

- Winter Park

- Winter Springs

- Wright

- Yeehaw Junction

- Yulee

- Zephyrhills

References

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are informational and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.