Many California renters choose coverage proactively — not just because landlords ask for it, but because it makes financial sense in a state with rising repair and replacement costs.

How much are people paying for Renters Insurance in California?

Below are real renters insurance quotes from people across California, including Brentwood, La Habra, Riverside, San Ramon, and RESEDA. These reflect a wide range of home types and coverage preferences.

| Quote Date | City | Monthly Premium | Property Type | Age Group |

|---|---|---|---|---|

| July 1, 2025 | Brentwood, California | $8 | Apartment | 25–34 |

| July 1, 2025 | La Habra, California | $5 | Apartment | 55+ |

| June 30, 2025 | Riverside, California | $6 | Apartment | 55+ |

| June 30, 2025 | San Ramon, California | $8 | Apartment | 35–44 |

| June 30, 2025 | RESEDA, California | $8 | Apartment | 55+ |

* Selected, anonymized quotes from past submissions. Last updated: July 1, 2025.

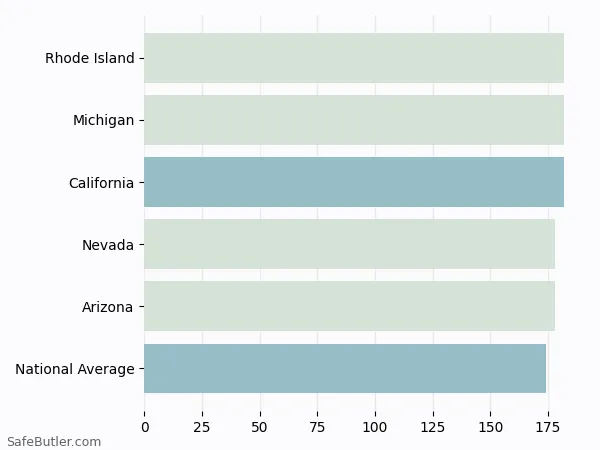

Renters insurance is one of the most affordable insurance in your daily life but can protect you financially from many risks. California tenants pay slightly higher than the national average. The chart below compares four states with close premiums and the national average.

If you want to know how much it costs for your rental home, hit the big button below to get free quotes.

Compare your options now — it’s free

Why do YOU need Renters Insurance?

Although renters insurance is not required by law in California, apartment complexes and landlords often need tenants to purchase Renters Insurance before signing the lease agreement. Because the landlord's insurance only covers the damage to the actual dwelling, your renters insurance will protect your belongings inside the apartment in case of fire, theft, or injury.

What factors impact the Renters Insurance premium?

- The amount of coverage you chose

- The value of your personal property and whether your policy covers ACV or replacement costs

- The amount of your deductible

- The amount of liability coverage you choose

- The location of your rental home

Are the crime rates exceptionally high in your neighborhood? Rates may be higher as a result. Is the area prone to higher risks for wind or hurricane damage? These factors matter as well. - Discounts

You may be eligible for discounts if you have purchased other insurance policies with the provider or bundled your insurance. There are also discounts available for renters with added security features- such as deadbolt locks, security systems, smoke detectors, etc.

What are the California renters insurance discounts?

Most carriers provide various discounts for renters insurance, just like auto insurance. Here are some most common deals.

| Discount | Description |

|---|---|

| Multi-Policy | If you purchase both renters and auto insurance from the same company, you may qualify for a discount for the auto insurance. |

| Secure Home | Secure home If you have extinguishers or burglar alarm devices or are in a gated community, you may qualify for the secured home discount. It averages about 5% from quite a few carriers. |

| Claim-free | Just like auto insurance is lower for accident-free drivers, renters insurance is also cheaper for claim-free tenants. If you have never reported any claims, you will qualify for claim-free discounts from several carriers. |

| Age | Usually, for renters insurance, older people pay less than younger people for a similar property. If you're a college student trying to find a renters policy for your apartment near school, you will pay more. |

| Good Credit | A customer with a credit score higher than 700 can often get a better rate than those who don’t. |

| Pay-in-full | If the carrier supports monthly and yearly payments, paying in full will usually give you a discount. In other words, if you choose to pay monthly, you should pay attention to the extra fee your carrier charges. |

| Paperless | A few providers have paperless discounts if you opt-in. But more modern insurance companies will give you a competitive offer directly with more digitalized systems. |

What are the risks to consider in California?

California tenants face the risks of natural hazards such as fire, floods, and earthquake. However, most renters insurance policies do not cover damages to your personal property caused by a flood or an earthquake. Therefore, it is also a good idea to check with your insurance agent and learn more about what policies cover these specific disasters.

Last but not least, thanks to the increased risk of the exposure of personal information on the Internet in today's digital world, it is also essential to check if your renter's insurance provides identity theft protection.

Looking for the best renters insurance in California?

Click here to get started. You can compare hundreds of Renters insurance companies at once to get free, no-obligation quotes in just 60 seconds.

Find the best renters insurance in California

Compare the top insurance brands at once for free

Renters Insurance Rates for Cities in California

We compiled data about Renters Insurance rates for every city in California. A word of caution, as you explore the list below, there is no doubt you will find a wide price range.

- Adelanto

- Agoura Hills

- Alameda

- Albany

- Alhambra

- Aliso Viejo

- Alondra Park

- Alpine

- Alta Sierra

- Altadena

- Alum Rock

- American Canyon

- Anaheim

- Anderson

- Antioch

- Apple Valley

- Aptos

- Arcadia

- Arcata

- Arden-Arcade

- Arroyo Grande

- Artesia

- Arvin

- Ashland

- Atascadero

- Atherton

- Atwater

- Auburn

- August

- Avenal

- Avocado Heights

- Azusa

- Bakersfield

- Baldwin Park

- Banning

- Barstow

- Bay Point

- Baywood-Los Osos

- Beaumont

- Bell

- Bell Gardens

- Bellflower

- Belmont

- Benicia

- Berkeley

- Bermuda Dunes

- Beverly Hills

- Blackhawk-Camino Tassajara

- Bloomington

- Blythe

- Bonadelle Ranchos-Madera Ranchos

- Bonita

- Bostonia

- Boyes Hot Springs

- Brawley

- Brea

- Brentwood

- Buena Park

- Burbank

- Burlingame

- Calabasas

- Calexico

- California City

- Calimesa

- Calipatria

- Camarillo

- Cambria

- Cameron Park

- Camp Pendleton North

- Camp Pendleton South

- Campbell

- Canyon Lake

- Capitola

- Carlsbad

- Carmichael

- Carpinteria

- Carson

- Casa de Oro-Mount Helix

- Castro Valley

- Castroville

- Cathedral City

- Ceres

- Cerritos

- Charter Oak

- Cherryland

- Chico

- Chino

- Chino Hills

- Chowchilla

- Chula Vista

- Citrus

- Citrus Heights

- Claremont

- Clayton

- Clearlake

- Cloverdale

- Clovis

- Coachella

- Coalinga

- Colton

- Commerce

- Compton

- Concord

- Corcoran

- Corning

- Corona

- Coronado

- Corte Madera

- Costa Mesa

- Cotati

- Coto de Caza

- Country Club

- Covina

- Crestline

- Cudahy

- Culver City

- Cupertino

- Cypress

- Daly City

- Dana Point

- Danville

- Davis

- Del Aire

- Delano

- Delhi

- Desert Hot Springs

- Diamond Bar

- Dinuba

- Discovery Bay

- Dixon

- Downey

- Duarte

- Dublin

- Earlimart

- East Compton

- East Foothills

- East Hemet

- East La Mirada

- East Los Angeles

- East Palo Alto

- East Pasadena

- East Porterville

- East San Gabriel

- El Cajon

- El Centro

- El Cerrito

- El Dorado Hills

- El Monte

- El Paso de Robles

- El Rio

- El Segundo

- El Sobrante

- Elk Grove

- Emeryville

- Encinitas

- Escondido

- Eureka

- Exeter

- Fair Oaks

- Fairfax

- Fairfield

- Fairview

- Fallbrook

- Farmersville

- Fillmore

- Florence-Graham

- Florin

- Folsom

- Fontana

- Foothill Farms

- Foothill Ranch

- Fort Bragg

- Fortuna

- Foster City

- Fountain Valley

- Fremont

- Fresno

- Fullerton

- Galt

- Garden Acres

- Garden Grove

- Gardena

- Gilroy

- Glen Avon

- Glendale

- Glendora

- Gold River

- Golden Hills

- Goleta

- Gonzales

- Grand Terrace

- Granite Bay

- Grass Valley

- Greenfield

- Grover Beach

- Hacienda Heights

- Half Moon Bay

- Hanford

- Hawaiian Gardens

- Hawthorne

- Hayward

- Healdsburg

- Hemet

- Hercules

- Hermosa Beach

- Hesperia

- Highland

- Hillsborough

- Hollister

- Home Gardens

- Huntington Beach

- Huntington Park

- Huron

- Imperial

- Imperial Beach

- Indio

- Inglewood

- Interlaken

- Ione

- Irvine

- Isla Vista

- Kentfield

- Kerman

- King City

- Kingsburg

- La Canada Flintridge

- La Crescenta-Montrose

- La Habra

- La Mesa

- La Mirada

- La Palma

- La Presa

- La Puente

- La Quinta

- La Riviera

- La Verne

- Ladera Heights

- Lafayette

- Laguna

- Laguna Beach

- Laguna Hills

- Laguna Niguel

- Laguna West-Lakeside

- Laguna Woods

- Lake Arrowhead

- Lake Elsinore

- Lake Forest

- Lake Los Angeles

- Lakeside

- Lakewood

- Lamont

- Lancaster

- Larkfield-Wikiup

- Larkspur

- Lathrop

- Lawndale

- Lemon Grove

- Lemoore

- Lennox

- Lincoln

- Linda

- Lindsay

- Live Oak

- Livermore

- Livingston

- Lodi

- Loma Linda

- Lomita

- Lompoc

- Long Beach

- Loomis

- Los Alamitos

- Los Altos

- Los Altos Hills

- Los Angeles

- Los Banos

- Los Gatos

- Lucas Valley-Marinwood

- Lynwood

- Madera

- Madera Acres

- Magalia

- Malibu

- Mammoth Lakes

- Manhattan Beach

- Manteca

- Marina

- Marina del Rey

- Martinez

- Marysville

- Maywood

- McFarland

- McKinleyville

- Mendota

- Menlo Park

- Mentone

- Merced

- Mill Valley

- Millbrae

- Milpitas

- Mira Loma

- Mira Monte

- Mission Viejo

- Modesto

- Monrovia

- Montclair

- Montebello

- Montecito

- Monterey

- Monterey Park

- Moorpark

- Moraga

- Moreno Valley

- Morgan Hill

- Morro Bay

- Mountain View

- Murrieta

- Muscoy

- Napa

- National City

- Newark

- Newman

- Newport Beach

- Nipomo

- Norco

- North Auburn

- North Fair Oaks

- North Highlands

- Norwalk

- Novato

- Oakdale

- Oakland

- Oakley

- Oceano

- Oceanside

- Oildale

- Ojai

- Olivehurst

- Ontario

- Opal Cliffs

- Orange

- Orange Cove

- Orangevale

- Orcutt

- Orinda

- Orland

- Orosi

- Oroville

- Oroville East

- Oxnard

- Pacific Grove

- Pacifica

- Palm Desert

- Palm Springs

- Palmdale

- Palo Alto

- Palos Verdes Estates

- Paradise

- Paramount

- Parkway-South Sacramento

- Parlier

- Pasadena

- Patterson

- Pedley

- Perris

- Petaluma

- Pico Rivera

- Piedmont

- Pinole

- Pismo Beach

- Pittsburg

- Placentia

- Placerville

- Pleasant Hill

- Pleasanton

- Pomona

- Port Hueneme

- Porterville

- Portola Hills

- Poway

- Prunedale

- Quartz Hill

- Ramona

- Rancho Cordova

- Rancho Cucamonga

- Rancho Mirage

- Rancho Palos Verdes

- Rancho San Diego

- Rancho Santa Margarita

- Red Bluff

- Redding

- Redlands

- Redondo Beach

- Redwood City

- Reedley

- Rialto

- Richmond

- Ridgecrest

- Rio Linda

- Rio del Mar

- Ripon

- Riverbank

- Riverside

- Rocklin

- Rodeo

- Rohnert Park

- Rolling Hills Estates

- Rosamond

- Rosedale

- Roseland

- Rosemead

- Rosemont

- Roseville

- Rossmoor

- Rowland Heights

- Rubidoux

- Sacramento

- Salida

- Salinas

- San Anselmo

- San Bernardino

- San Bruno

- San Buenaventura

- San Carlos

- San Clemente

- San Diego

- San Diego Country Estates

- San Dimas

- San Fernando

- San Francisco

- San Gabriel

- San Jacinto

- San Jose

- San Juan Capistrano

- San Leandro

- San Lorenzo

- San Luis Obispo

- San Marcos

- San Marino

- San Mateo

- San Pablo

- San Rafael

- San Ramon

- Sanger

- Santa Ana

- Santa Barbara

- Santa Clara

- Santa Clarita

- Santa Cruz

- Santa Fe Springs

- Santa Maria

- Santa Monica

- Santa Paula

- Santa Rosa

- Santee

- Saratoga

- Sausalito

- Scotts Valley

- Seal Beach

- Seaside

- Sebastopol

- Selma

- Shafter

- Shasta Lake

- Sierra Madre

- Signal Hill

- Simi Valley

- Solana Beach

- Soledad

- Sonoma

- South El Monte

- South Gate

- South Lake Tahoe

- South Oroville

- South Pasadena

- South San Francisco

- South San Gabriel

- South San Jose Hills

- South Whittier

- South Yuba City

- Spring Valley

- Stanford

- Stanton

- Stockton

- Suisun City

- Sun City

- Sunnyvale

- Susanville

- Taft

- Tamalpais-Homestead Valley

- Tehachapi

- Temecula

- Temple City

- Thermalito

- Thousand Oaks

- Tiburon

- Torrance

- Tracy

- Truckee

- Tulare

- Turlock

- Tustin

- Tustin Foothills

- Twentynine Palms

- Twentynine Palms Base

- Ukiah

- Union City

- Upland

- Vacaville

- Valinda

- Valle Vista

- Vallejo

- Valley Center

- Vandenberg AFB

- Victorville

- View Park-Windsor Hills

- Vincent

- Vineyard

- Visalia

- Vista

- Walnut

- Walnut Creek

- Walnut Park

- Wasco

- Waterford

- Watsonville

- West Athens

- West Carson

- West Covina

- West Hollywood

- West Modesto

- West Puente Valley

- West Sacramento

- West Whittier-Los Nietos

- Westlake Village

- Westminster

- Westmont

- Whittier

- Wildomar

- Willowbrook

- Willows

- Windsor

- Winter Gardens

- Winters

- Winton

- Woodcrest

- Woodlake

- Woodland

- Yorba Linda

- Yreka

- Yuba City

- Yucaipa

- Yucca Valley

References

Find your perfect insurance policy

Compare the top insurance brands at once for free

Disclaimer

Our articles are informational and should not be considered legal or financial advice. Our

articles are not written or reviewed by insurance agents. Consult your policies with your agent or a

professional for details regarding terms, conditions, coverage, exclusions, products, services, and programs.

SafeButler Inc. strives to ensure that the information on this site is up to date, but we will not be held

liable for any delays, inaccuracies, errors, or omissions. This site and all materials contained on it are

distributed and provided "as is" and "as available" for use. SafeButler.com makes no representations or

warranties of any kind, express or implied, as to the operation of this site or to the information, content,

materials, or products included on this site. You expressly agree that your use of this site is at your sole

risk.